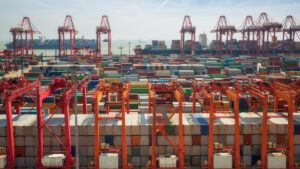

More than just Events: The Impact of Global Events on Logistics and Supply Chains

In an interconnected world, global events have a profound impact on logistics and supply chains, shaping the way goods are transported, stored, and delivered. From

In an interconnected world, global events have a profound impact on logistics and supply chains, shaping the way goods are transported, stored, and delivered. From

In the fast-paced world of logistics, the integration of Artificial Intelligence (AI) is revolutionizing decision-making processes and optimizing supply chain operations. AI brings a new

The need of well built supply chain models which has a clear understanding of the future of logistics to meet the consumers demand for goods

In the interconnected world of logistics, the strategic significance of canals cannot be overstated. Canals serve as crucial arteries for global trade, facilitating the transportation

The Supply Chain & Logistics industry is a dynamic and rapidly evolving field offering diverse opportunities for career growth. Securing your dream job in this

In the dynamic landscape of logistics, staying at the forefront of industry trends and knowledge is paramount. Collaborative initiatives play a pivotal role in advancing

Within the dynamic and constantly changing field of logistics, education is a critical factor in determining the direction of this vital industry. The increasing globalisation

Trade agreements are essential to the development of global commerce in today’s interconnected world because they make cross-border transfers of goods and services easier. These

In the fast-paced world of logistics, where accuracy and productivity are critical, customer service is a critical component of success. This blog explores the elements

Not too long ago, supply chain enthusiasts and industry insiders were the only ones who could use the term “last mile” in logistics. Thanks to

Even though supply chains can be extremely complicated, things can go wrong with them quite easily at times. Failing supply chains can have a lasting

In today’s interconnected global economy, the field of international logistics plays a pivotal role in facilitating the smooth flow of goods across borders. Whether you’re

Theoretical knowledge alone often falls short of preparing students for real-world challenges in Logistics. This is where internships come into play. Logistics internships provide students

The realm of freight transportation is undergoing a paradigm shift, fueled by technological innovations, changing consumer demands, and sustainability concerns. As logistics professionals strive to

In today’s rapidly evolving world of logistics, where technological advancements and automation are reshaping the industry, it’s easy to overlook the significance of the human

Defining Logistics and Supply Chain Management: Logistics and supply chain management encompass the orchestration, implementation, and supervision of the movement and warehousing of goods and

The logistics industry is one of the fastest-growing industries in the world, and Kerala is no exception. The state is home to a number of

The logistics industry plays a pivotal role in the global economy, ensuring the smooth and efficient movement of goods and services. As businesses continue to

The Indian logistics and warehousing industry is undergoing a major transformation, driven by the adoption of automation technologies. Automation is having a significant impact on

If logistics—the network of services that enables the movement of commodities across or inside national borders—were not present, the majority of the things we consume

In the world of logistics, efficient warehouse management is crucial for maintaining smooth operations and meeting customer demands. Warehouse management systems (WMS) play a vital

Third-party logistics (3PL logistics) suppliers are external service providers to meet end-to-end logistics requirements of businesses, right from procurement and warehousing to shipment tracking and

Warehouse facilities are a requirement for the majority of businesses that produce, import, export, or transport commodities. Even while you might think it’s a wasted

The most significant and intricate sector of the global economy is logistics and supply chain management. It does, however, face some significant problems in the

The demand from customers is increasing along with their level of technological sophistication, therefore supply chain management needs to be more responsive in all areas.

You cannot survive if you don’t speak the language of the area. Grab a phrasebook to familiarise yourself with the fundamentals before travelling to a

On their path to digitalization, everyone is at a different stage. The majority of businesses have already begun using digital techniques for one or more

Any effective business executive is aware of how crucial well-organized logistics are. They understand that providing frictionless logistics is essential to satisfying customer expectations and

You’ve repeatedly searched the internet for logistics jobs, read up on job descriptions, and done extensive research on everything involved in a supply chain management

Understanding the nature of this activity requires an understanding of a number of related issues that come up when discussing shipping management. Shipping—refers to the

The administration of processes involved in the acquisition of raw materials, their transformation into completed items, and their distribution to the final consumer is known

Today the business world is quite dynamic. One needs to be updated and have a comprehensive understanding of how it operates. Unexpected changes like the

Logistics is the backbone of the economy because it assures the efficient and cost-effective flow of products. Because of its wide range of prospects and

Pharma logistics is one of the foremost important stages of the operations for any pharmaceutical business because the activities are highly time sensitive. It’s very

Outbound logistics is that the shipping out of finished products to customers from a warehouse or distribution centre. It consists of the order fulfilment process including picking,

For online businesses, eCommerce warehousing is not just a storage space but also an integral part of order fulfillment. Having the right eCommerce warehouse can

Careers in Logistics, Shipping, and Supply Chain are overlooked by the young talents of today due to the following reasons. 1.Logistics is a big business

The warehousing sector in India has been growing tremendously day after day due to the boost in the international market. Entry of domestic as well

WhatsApp us